It’s been a mixed year for the NFTs, with some impressive highs and some unfortunate lows. Here we look back at what happened in 2022, from the big players to the new startups. It’s evident that the NFT market had cooled off since last year, when it was on everyone’s radar. When comparing 2021 to 2022, it seems people have lost enthusiasm for this emerging asset class, and the hype surrounding them has diminished significantly.

As 2021 began, the NFTs and virtual worlds market appeared to be experiencing a boom. Everyone from Fortune 500 companies to renowned celebrities were investing in this phenomenon. Mark Zuckerberg pledged billions towards Meta’s Horizon Worlds metaverse project alone. Unfortunately, by September 2022, trading volumes had plummeted 97%. An additional two months saw them dive an astonishing -99% from their peak.

As the crypto market plummeted by a staggering $2 trillion between November 2021 and July 2022, NFTs were unfortunately hit even harder. Even those valued in six digits are now down an incredible 99%. The decrease in interest in NFTs can be attributed to multiple reasons, with some being: the unregulated market practices leaving room for potential scams; a plunge in crypto prices this year affecting their worth, and an unpredictable investment environment due to its reduced value.

Let’s dig deeper into some of the crucial events that happened over the year.

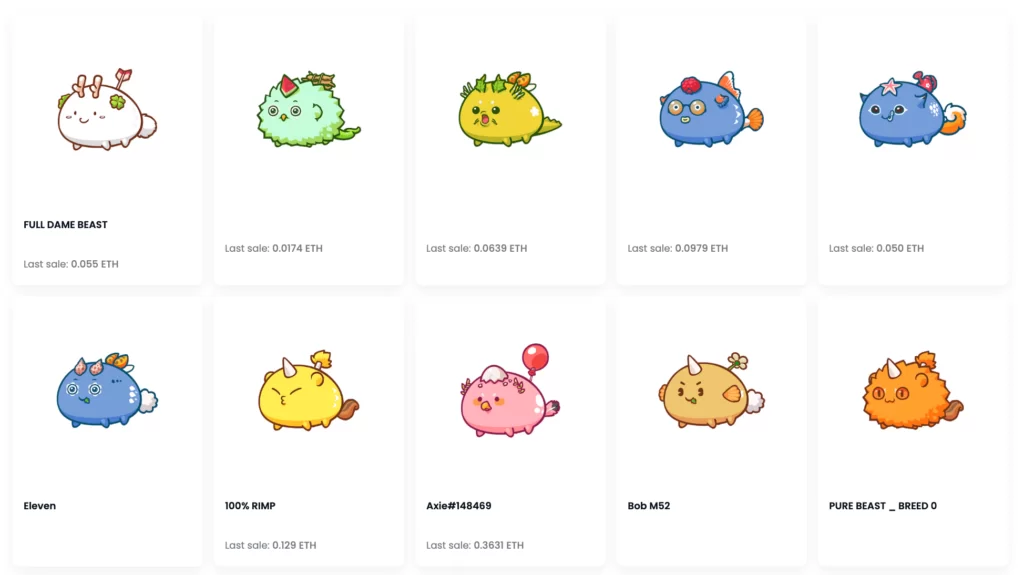

Axie Infinity’s Continous Downfall

In 2021, Axie Infinity, crafted by Vietnam’s Sky Mavis studio, quickly became a sensation. Most of its players come from the Philippines. Initially, it was so successful that even investment managers were connected to it; however, due to an unfortunate hack that resulted in US$600 million stolen away—Axie Infinity had seen better days.

Axie Infinity has always been one of the most successful crypto-based NFT games, offering its players an incredible opportunity to earn substantial amounts of money.

The US government has identified North Korean-linked hackers, Lazarus Group, to have targeted employees of Sky Mavis who develop the popular game, Axie Infinity. These malicious individuals took advantage of their victims through a fake company they set up on LinkedIn and proceeded with bogus job interviews followed by an incredibly attractive ‘compensation package’.

The hacker infiltration culminated in an unsuspecting senior engineer clicking a PDF containing the official offer – leading to his computer being compromised and four out of nine nodes used to confirm financial transactions on Sky Mavis’ Ronin blockchain. This dangerous breach was not detected until it had already cost substantial amounts of money, data, and time.

It was an advanced spear-phishing attack that saw the thieves siphon off approximately $625 million worth of cryptocurrency (at that time) from Sky Mavis’ treasury, a heist that went unnoticed for close to one week during March. Post-mortem reports attributed the hack to an ex-employee – though they failed to shed light on how it actually took place.

Doodles’ Raises $54 million, Plans To Expand NFT Through Music

Doodles declared that it had raised a grand total of $54 million in its latest funding round led by Reddit co-founder Alexis Ohanian. As a result, the company is now valued at an impressive $704 million – even though its floor price declined from a 25.5 ETH all-time high back in May to 7.1 ETH just before their announcement.

©Doodle

The project came under fire recently due to the fact that it hadn’t tweeted in over a month and a half before Tuesday’s announcement. The last time they put out the news was when singer Pharrell Williams became their Chief Brand Officer back in June.

Julian Holguin, CEO of Doodles, expressed enthusiasm for the project’s ongoing efforts to nurture and promote individuals’ uses of their characters in commercial endeavours: “We’re incredibly eager to facilitate other people’s use of their original creations. As long as it is properly managed.”

Holguin emphasized that Doodles is uniquely poised to bridge the gap between individuals and Web3, utilizing music-based NFTs.

“We want to create products for our core collector base,” he said, “but at the same time utilize these great forms of marketing like music to introduce new people to Web3 and onboard them into the Doodles ecosystem.”

CryptoPunk #5822 Sold for a Record-breaking $23.7 Million (8000 ETH)

Larva Labs revolutionized the NFT industry in 2017 when they introduced their one-of-a-kind CryptoPunks collection. This unique set consists of 10,000 distinct pixelated characters stored securely on the Ethereum blockchain. On the 12th of February, Chain’s CEO, Deepak Thapliyal, invested 8,000 ETH ($23.7 million) in CryptoPunk #5822.

CryptoPunk #4156, selling for a whopping $10.2 million (2,500 ETH) in December 2021, was the most expensive sale of this CryptoPunk until it surpassed its own record with another auction at Sotheby’s. This new transaction entirely smashed the old benchmark: just last June 2021, an individual spent $11.8M on acquiring CryptoPunk #7523 from them.

Thapliyal’s CryptoPunk #5822 is notably esteemed as an “alien” since there are merely nine of these non-fungible tokens (NFTs) out of the 10,000 NFT components within the collection.

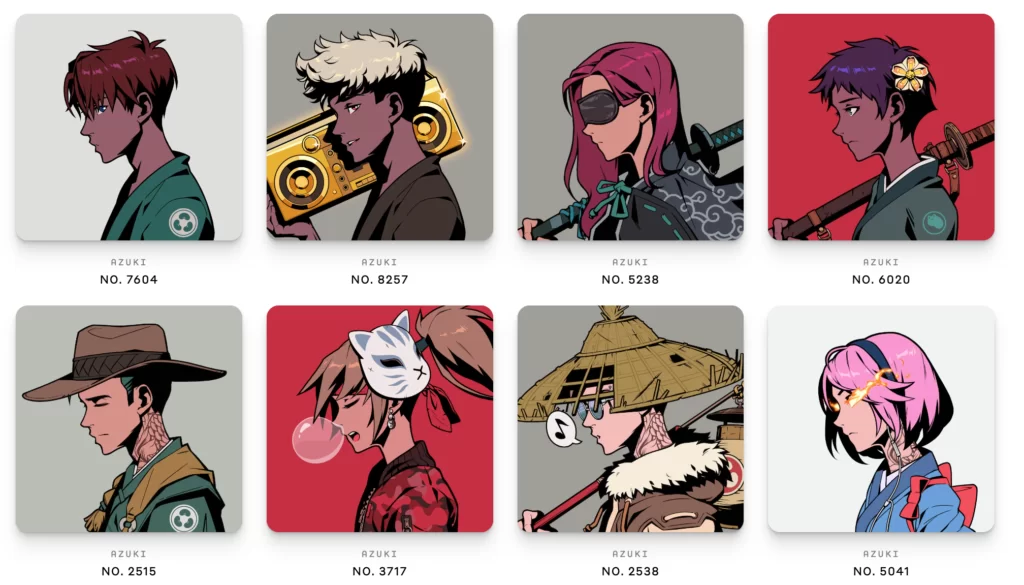

Azuki Taking over Q1 2022, With its own Downfall

In January 2022, Chiru Labs introduced the Azuki NFT project with over 10,000 unique anime-inspired pictures. Ethereum is the platform hosting these NFTs, and they have swiftly become popular on OpenSea. Hours after their first collection launch, Azuki earned a whopping $28 million in profit. With an impressive growth trajectory since its inception earlier this year, it comes as no surprise that Azuki continues to be one of the most successful projects out there today.

©ChiruLabs

Azuki has seen huge success since its launch in January, garnering hundreds of millions of dollars worth of trading volume within the first several weeks. By March 2022, this number had skyrocketed to an estimated $500 million.

Azuki has seen a meteoric rise in popularity due to the pent-up demand for anime art. After Netflix began airing anime content, it reported that over 100 million households had viewed an anime show within one year’s time. In comparison, a prior anime-style collection called 0N1 Force was released in August of 2021. Within two short weeks after its release, its average price skyrocketed from $1,500 to a staggering $30,000.

A stunning and unprecedented event occurred when Azuki #9605 sold for an astonishing 420.69 ETH, the equivalent of $1.42 million USD at the time, on the OpenSea marketplace. This extraordinary feat more than doubled the previous record sale for this project – 204 ETH or approximately $586,000 USD was paid for Azuki #4666 back on February 13th.

Azuki’s journey was not only marked by success but also missteps. Azuki CEO, Zagabond chronicled his involvement with abandoned projects CryptoPhunks, Tendies, and Cryptozunks in a blog post that exposed the truth behind NFT history.

Upon the announcement, a significant number of NFT community members expressed angry disapproval as they expected that the details would soon be uncovered through an on-chain investigation. In April 2021, the cost of an Azuki on OpenSea’s secondary marketplace abruptly plummeted from 19 ETH (approximately $42,000) to 10.9 ETH (roughly $24,000), but since then has risen back up to 12 ETH ($31,000) due to floor buyers and believers.

Azuki has sold a tremendous amount of Ethereum since its inception, currently standing at 200,000 ETH (which is an astonishing $526 million) and taking the 6th spot in all NFT projects.

Yuga Labs (Bored Ape Yacht Club) Purchases Its Top NFT Competitor Cryptopunks

Yuga Labs, the creative masterminds behind the Bored Ape Yacht Club NFT collection, has just purchased CryptoPunks and Meebits from Larva Labs. In March, Yuga Labs and Larva Labs generated a joint statement on Twitter to share with the world. “We now own the brands, copyright in the art, and other IP rights for both collections, along with 423 CryptoPunks and 1711 Meebits,” reads Yuga Labs’ blog post.

Not only is Bored Ape Yacht Club the most sought-after NFT collection in crypto, but CryptoPunks come as a close second. Yuga Labs has planned to deliver commercial rights of all Meebits and Cryptopunk images to their holders too – they have already granted these privileges to members of Bored Ape.

Owners can capitalize on this opportunity by launching their own distinct NFT collections based around particular apes or signing deals with major record labels. With such immense potential at hand, it’s no wonder why everyone wants a piece of the action!

With today’s acquisition, Yuga Labs is clearly dominating the NFT space. However, this Company isn’t stopping there; they have already initiated merch drops and released a special mobile game as well as throwing star-studded parties in Brooklyn. It seems that these forward thinkers are always one step ahead of their competition when it comes to transforming an idea into reality.

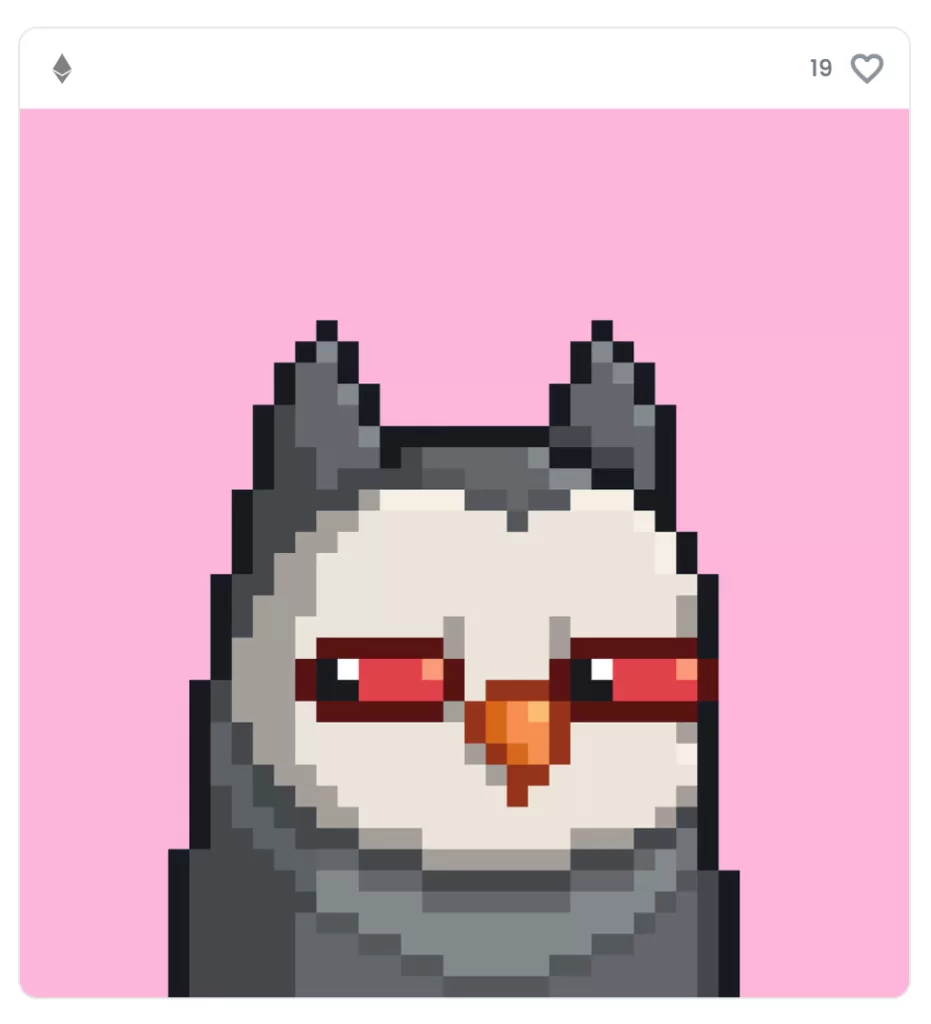

PROOF Collective’s Moonbirds Takes Flight

In a little over one week, Moonbirds NFTs (non-fungible tokens) had fetched an impressive $445 million in sales; thereby making it the most sought-after collection of April. The numbers are astounding and demonstrate that this project took the NFT space by storm.

©PROOF Holdings

On April 16, the Moonbirds collection of 10,000 pixelated bird NFTs was released and, within days skyrocketed in price. Analysts attribute this boom to its being developed by the elite Proof Collective composed of 1,000 avid NFT collectors as well as one of its original founders Kevin Rose.

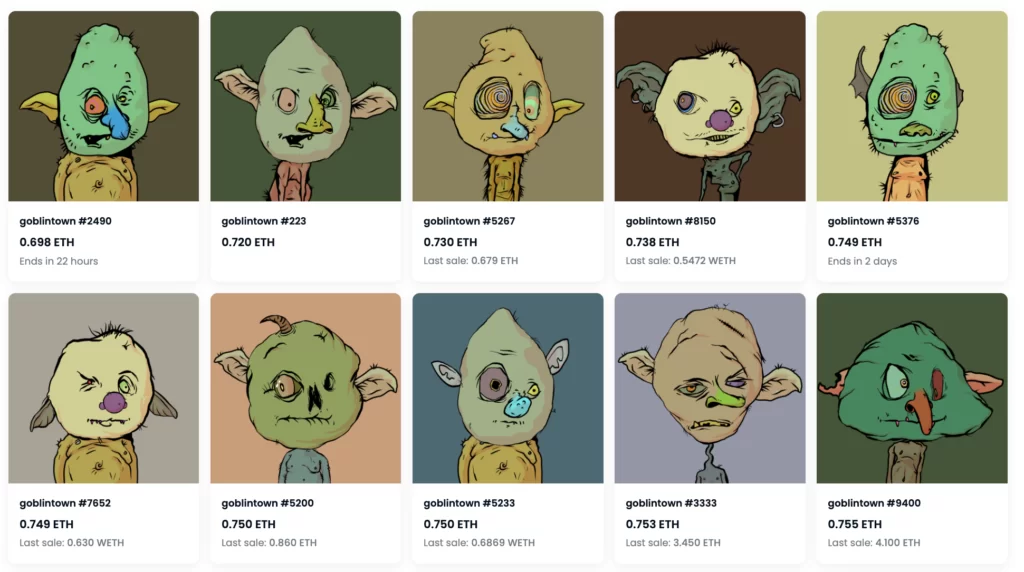

Goblintown, a Free NFT Project That Took The Space By Storm

After a dreary month of crypto-trading, Twitter was consumed by an NFT Space on May 26, with the so-called “NFT Winter”, which let this cold season leave traders in near-freezing conditions with activity levels lower than August 2021’s notorious NFT Boom. On the day of its launch, Goblintown was an anonymous and unknown NFT collection that could be minted for free. In just 12 days since then, the entry price on OpenSea’s marketplace has skyrocketed from zero dollars to a staggering $11,500 in May (6 ETH) and even reached a 9 ETH peak floor price.

Despite its criticism and significance in setting a low standard for the NFT space, Goblintown has injected much-needed energy into the NFT market that had lost steam over the past months of NFT Winter. With multiple competitors launching and spin-offs taking over the market, it has been a hell of a ride for the NFT space in the months of June and July.

Highly Anticipated ‘Baller Ape Club’ Pulls the Rug

On October 1 2021, the awaited Baller Ape Club NFT drop went live with 5,000 apes made obtainable to the mint at a price point of 2 SOL. Just after all had been sold out, something extraordinary occurred: The admins behind this project suddenly deleted their Discord, websites and Twitter accounts. It was clear that it must have been an exit scam as investors began to confirm on Twitter – and these suspicions quickly spread like wildfire!

After conducting an in-depth on-chain analysis, it was found that the Baller Ape Club had absconded with a whopping $2 million USD worth of Solana from investors–the biggest NFT rug pulls to date on any blockchain. To ensure justice is served and provide extra details about this incident, the Government and investors are collaborating closely with law enforcement agencies and fellow industry partners.

Ryder Ripps vs Bored Ape Yacht Club

As this case is set to be one of the most talked about events in the NFT space, Yuga Labs are suing artist Ryder Ripps for allegedly infringing on their trademark and intellectual property through his work with the Bored Ape Yacht Club (BAYC) NFT series. However, Ripps insists that he is a victim of attempted censorship from the company. This legal battle will no doubt cause ripples across the entire crypto art space as both parties fight for justice.

This suit is the result of an imitative collection of NFTs dubbed Ryder Ripps Bored Ape Yacht Club (RR/BAYC) by Yuga Labs, which claims to be a part of Ripp’s malicious online campaign that includes accusations claiming Nazi ties with BAYC.

Ripps, the proprietor of gordongoner.com – a website that takes its namesake from one of BAYC’s co-founders – has exposed numerous “degrading” traits present in their NFTs which, according to him and several other people, appear to be engineered with the intention of depicting African American and Asian persons as primates. Additionally, Ripps claims that those responsible for establishing BAYC have intentionally introduced Nazi signs into their project.

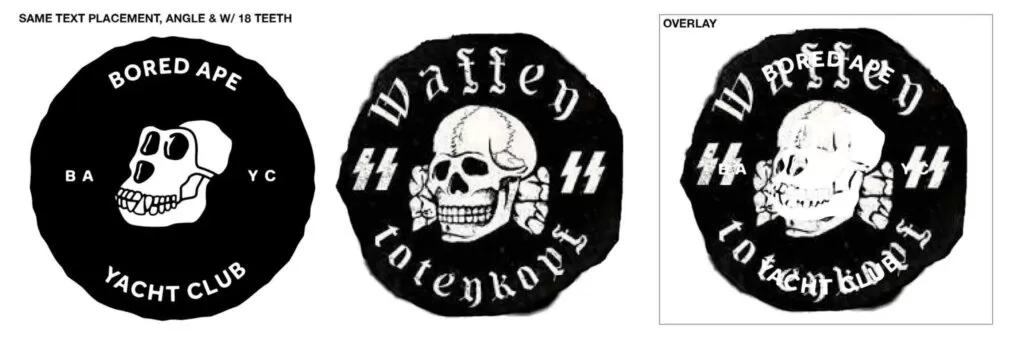

According to Ripps, the information he collected is primarily composed of symbols and visuals taken from the past of alt-right/4chan crypto groups. He highlighted one such image: BAYC logo, which bears a resemblance to the Nazi Totenkopf emblem.

Yuga Labs proclaimed in a Twitter statement, “We will continue to be transparent with our community as we fight these slanderous claims. In order to put a stop to the continuous infringement, and other illegal attempts to bring harm to us and the BAYC community, we have filed a lawsuit against the responsible parties. We will continue exploring and pursuing all legal options at our disposal.” The company is petitioning for a jury trial.

Mojang, (Creator of Minecraft), Destroys NFTs that live under the Minecraft ecosystem

Mojang, the creator of Minecraft, has announced that it does not condone Non-Fungible Tokens (NFTs) due to their environmental impact. “Create a scenario of the haves and the have-nots.”

Microsoft-owned Minecraft has decided not to endorse Non-fungible Tokens (NFTs) because they tend to create an environment where some members are privileged while others remain disadvantaged.

Mojang’s new guidelines had a shattering effect on NFT Worlds, an imaginative metaverse gaming venture under Minecraft that enabled players to buy Non-Fungible Tokens (NFTs) associated with “world seeds” for creating respective Minecraft universes.

Following Mojang’s announcement of the policy change, the floor price of NFT Worlds plummeted to less than one-third of its actual worth, and the cost of each individual NFT dropped from 3 ETH ($4,500) down to 1 ETH ($1,500), reflecting over 60% reduction in value. On July 21, the transactions leapt 34 times from the prior day. NFT owners began to rapidly sell off their digital assets at a lower price point. On that same day, an average token was valued at 1.05 ETH ($1,500). However, in April 2022, it spiked up to 11.8 ETH ($18,000) and even reached $30k (20ETH) – which is its all-time peak.

The founders of NFT Worlds released a public statement to token holders in the project’s Discord, expressing surprise and dismay at Microsoft and Mojang’s unexpected decision.

If the NFT Worlds developers are unable to resolve matters with Mojang, they have a backup strategy. Reportedly, they will contemplate relocating their platform to an alternate game similar to Minecraft’s sandbox. Furthermore, other measures may be implemented as well.

Conclusion

The NFT space was an actual roller coaster in 2022, with peak highs and peak lows over the year. It was a hectic time with many ups and downs in the space. Despite all of the challenges that arose. However, many people still see the value and the potential of NFTs and believe we will witness continued growth in this space. With the recent investment from Nike, Adidas, Gucci, Nickelodeon, McLaren, and more.

Until then, DYOR (Do your own research)