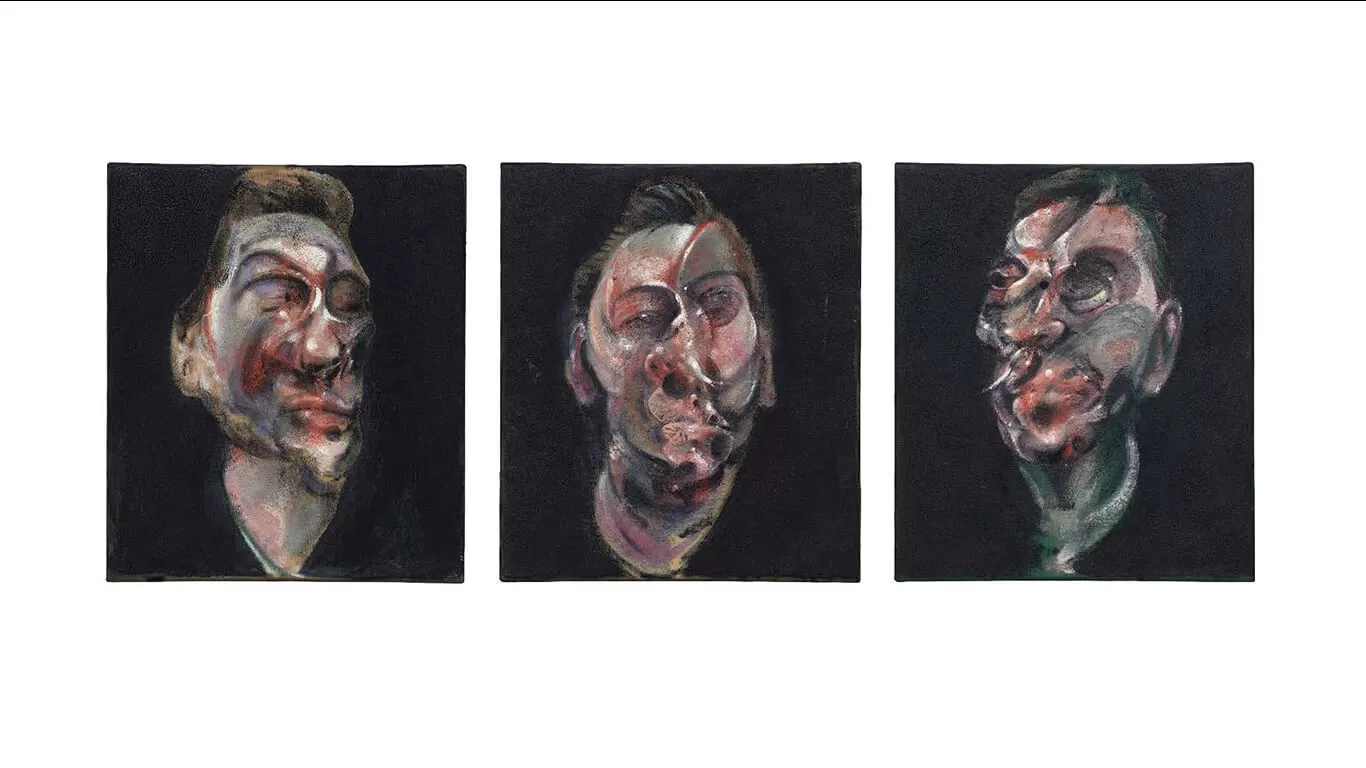

ARTEX announces that the first artwork to be admitted to trading is the ‘Three Studies for a Portrait of George Dyer’ (the “Artwork”), an oil on canvas triptych painted by the British artist, Francis Bacon in 1963. It belongs to a unique series of five Dyer portrait triptychs that Bacon created between 1963 and 1969 at the height of his career. This portrait is the first of its series of Dyer who would go on to become Bacon’s greatest muse. It sold at auction in May 2017 for nearly $52 million and will be offered to investors at an attractive valuation starting at around $55 million.

The Artwork to be listed by Art Share 002 S.A. (the “Issuer”), a public limited liability company incorporated in Luxembourg, is a securitisation vehicle governed by the Securitisation Law of Luxembourg. The Issuer facilitates the offering to the public in the form of ordinary shares with a nominal value of $100, which will be regulated, liquid and tradeable on the ARTEX MTF.

The Issuer filed a Listing Prospectus on the 19th of May 2023 with the financial regulator of Luxembourg, the Commission de Surveillance du Secteur Financier. The Listing Prospectus will be published on artex website at the start of the pre-marketing phase. It relates to the admission of trading and listing on the ARTEX MTF market, a Multilateral Trading Facility (“MTF”, as defined within the MiFID II regime) regulated by the Liechtenstein Financial Market Authority, of class B EUR shares of the issuer.

The Issuer intends to initially list on ARTEX MTF 385,000 class B EUR shares corresponding to 70% of all class B shares, at a price in EUR equivalent to USD 100 per share, through a secondary offering only (the “Offering”). The Offering is only available through the placement agents (banks and brokers), who have been appointed by the Issuer, pursuant to the placing agreement.

The investment opportunity shall be presented to potential investors during the pre-marketing phase, which may last up to 4 weeks, and which is expected to happen between 19th of June 2023 and 19th of July 2023. The book building phase is then expected to start on 5th of July 2023 and to end on 20th July 2023. Finally, it is expected that the admission to trading will become effective and that dealings will commence on 21st July 2023, under the symbol “BAC1EU” and International Securities Identification Number (“ISIN”) LU2583605592. The final terms of the Offering and the admission to trading will be published once the placement is concluded on ARTEX‘s website.

H.S.H. Prince Wenceslas of Liechtenstein, ARTEX Co-Founder and Chairman stated: “To offer a masterpiece by Francis Bacon as the first listing on ARTEX is a great privilege but also a responsibility. Three Studies for a Portrait of George Dyer is one of the most famous triptychs in modern art history, realised at Bacon’s artistic peak, during a particularly turbulent and productive period in his life.

Bacon is the first artist to be brought to the public by ARTEX. To fulfil this responsibility, ARTEX needs to operate a fair and fully transparent trading venue that is accessible and protective of all. ARTEX operates under one of the most rigorous regulatory frameworks to foster a high level of trust. For investors to see more iconic artworks be traded on the ARTEX stock exchange in the future, trust is essential.”

The ARTEX MTF offers a continuous trading model in connection with auctions. It starts with an opening auction, followed by continuous trading via a central limit order book. Then,trading ends with a closing auction. The MTF participants consist of members and market makers in accordance with regulation and facilitate the trading of shares by the Issuer to trade with a certain liquidity.

ARTEX has secured partnerships with well-established stock exchange infrastructure service providers to ensure a seamless trading experience and a robust trading platform. SIX will provide services relating to clearing as well as market data feed whilst settlement will happen through the bridge offered via Euroclear and Clearstream. UnaVista, an LSEG business, will support ARTEX in fulfilling its information exchange and reporting to the relevant supervisory bodies.

Rothschild & Co is acting as financial advisor to ARTEX in relation to the IPOs of the artworks.

©2023 ARTEX, Francis Bacon